by admin

Share

by admin

Share

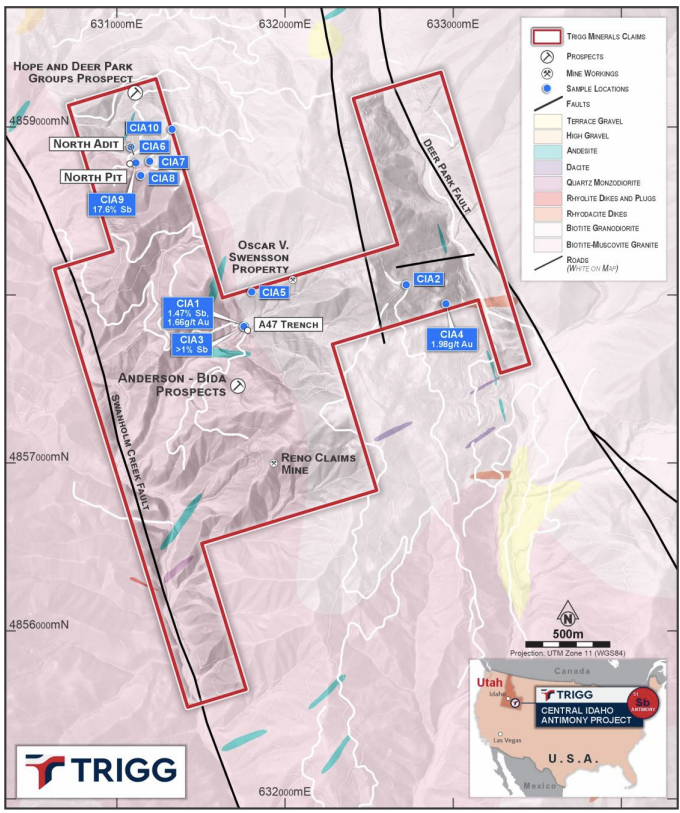

Location, geology, claim boundary, historical prospects and rock chip locations, Central Idaho Antimony Project, Idaho.

Trigg Minerals has signed a binding deal to acquire 100% of the Central Idaho Antimony (CIA) Project in the Swanholm (Middle Boise) Mining District of Idaho, USA— consisting of 52 unpatented lode claims about 120 km north-east of Boise. The consideration is US$4.965 m staged over up to 84 months, with a 2.5% NSR (50% buy-back to 1.25% for US$2 m within 72 months) and minimum work commitments of US$2.5 m over 72 months. To accelerate the program, Trigg has secured a A$5.0m strategic placement from Tribeca at A$0.09 per share with 1-for-2 options at A$0.10 (3-year)—funding fieldwork at CIA and potential U.S. main-board listing.

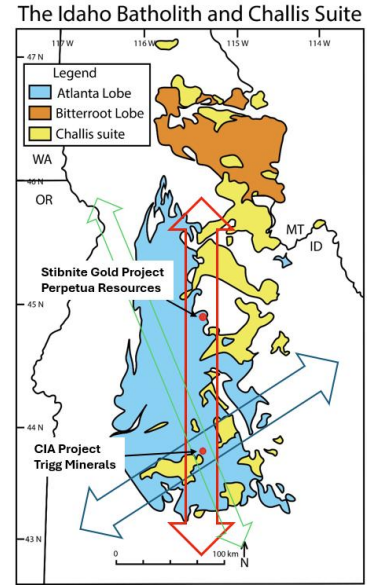

Principal structural architecture of the Atlanta Lobe (Idaho Batholith) showing N–S to NNW shear corridors intersected by NE-trending Trans-Challis faults (with subordinate NW sets). These intersections and batholith–roofpendant contacts focus Au–Sb mineralisation, exemplified by Stibnite (Au+Sb), and CIA (Sb) Projects.

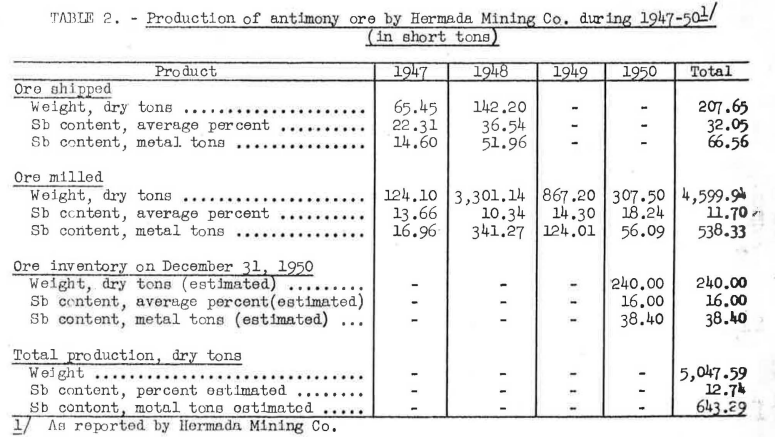

Geologically, CIA sits adjacent to the historic Hermada Mine and along the Hermada fracture zone (Black Warrior belt)—a corridor known for parallel quartz–stibnite veins and stockwork that can host high-grade shoots as well as bulk-tonnage mineralisation. Recent and historic sampling confirms high-grade stibnite at surface (including assays up to ~17.6% Sb), while old mill records from the district point to an average ore grade around 11.7% Sb and strong recoveries (~86%) to a saleable ~60% Sb concentrate with low deleterious elements. The presence of Gold is also noted: massive stibnite at the A47 Showing (>1% Sb) reports ~0.19 g/t Au, and re-assessed historical data indicate gold grades up to ~3.1 g/t in places.

From a development standpoint, the project benefits from year-round road access, proximity to Boise (workforce, services) and a low legacy footprint—most historical ore was milled off-site, leaving minimal tailings on the ground. The immediate plan focuses on trenching and channel sampling, adit re-entry mapping/sampling, and district-scale prospecting and mapping, followed by LIDAR interpretation, IP geophysics and a maiden drill program targeting both high-grade veins and broader stockwork zones.

Importantly, Idaho is a favourable jurisdiction for antimony. The state has moved to streamline approvals via the SPEED Act, while federal momentum is clear with Perpetua’s Stibnite-Gold Antimony Project receiving key approvals—ample evidence that critical-minerals projects can progress from discovery to development in Idaho. Against a backdrop where the U.S. still relies on imported antimony, CIA’s location, grade profile and straightforward logistics position it as a timely, strategically aligned opportunity.

Backed by a A$5.0 m strategic placement from Tribeca for the Central Idaho Antimony program, Trigg secures not just capital but a credible, resources-specialist partner with a proven track record. Tribeca recently cornerstoned Locksley Resources (ASX: LKY) at A$0.095 in Aug 2025; LKY now trades around A$0.60, representing an increase of approximately 530% since.

Production of Antimony ore at the adjacent Hermada Antimony mine