by admin

Share

by admin

Share

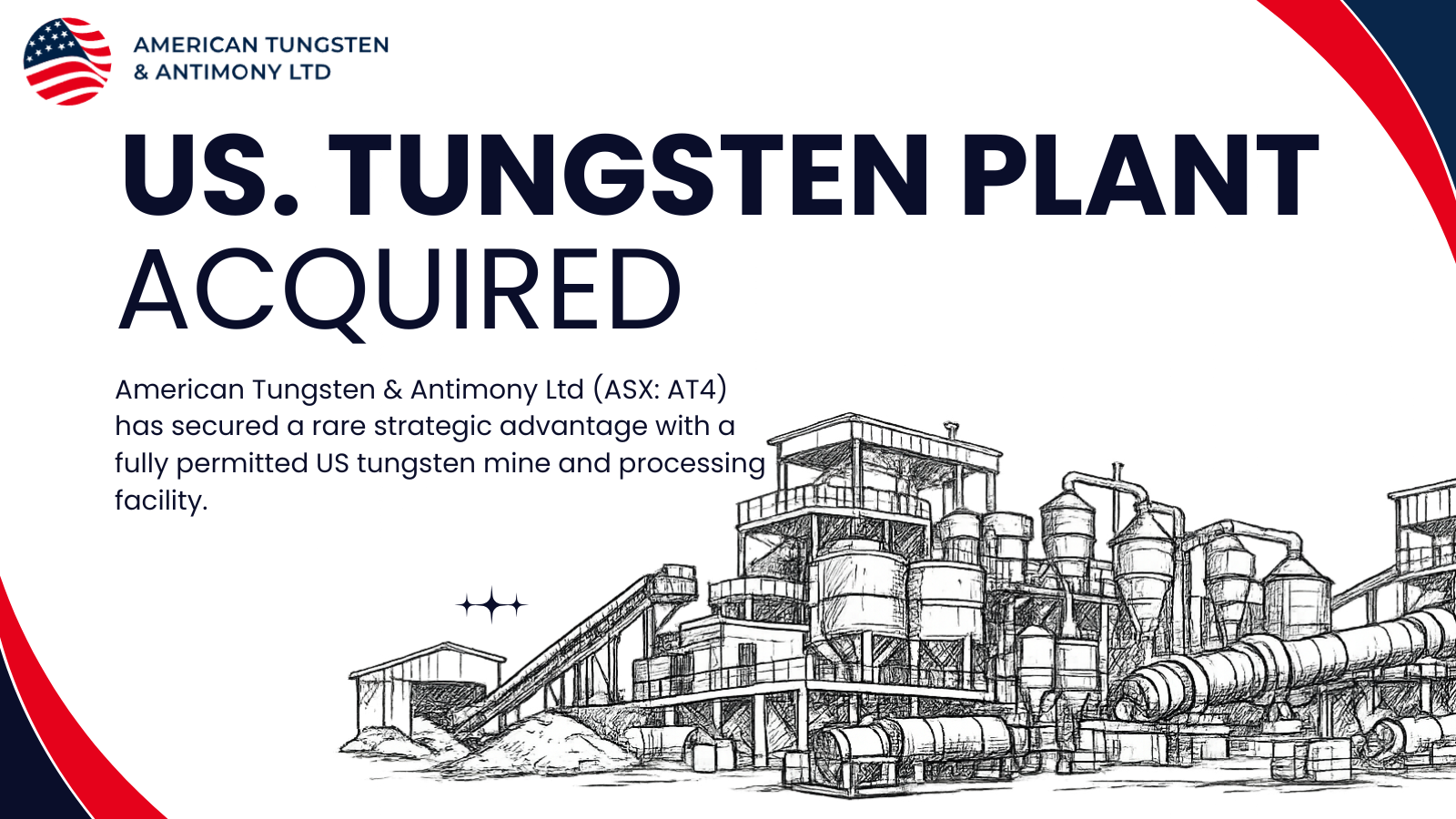

AT4 Secures Fully Permitted US Tungsten Infrastructure as Prices Rise and Supply Tightens

American Tungsten & Antimony Ltd (ASX: AT4) has taken a decisive step in the US critical minerals space, announcing the acquisition of the

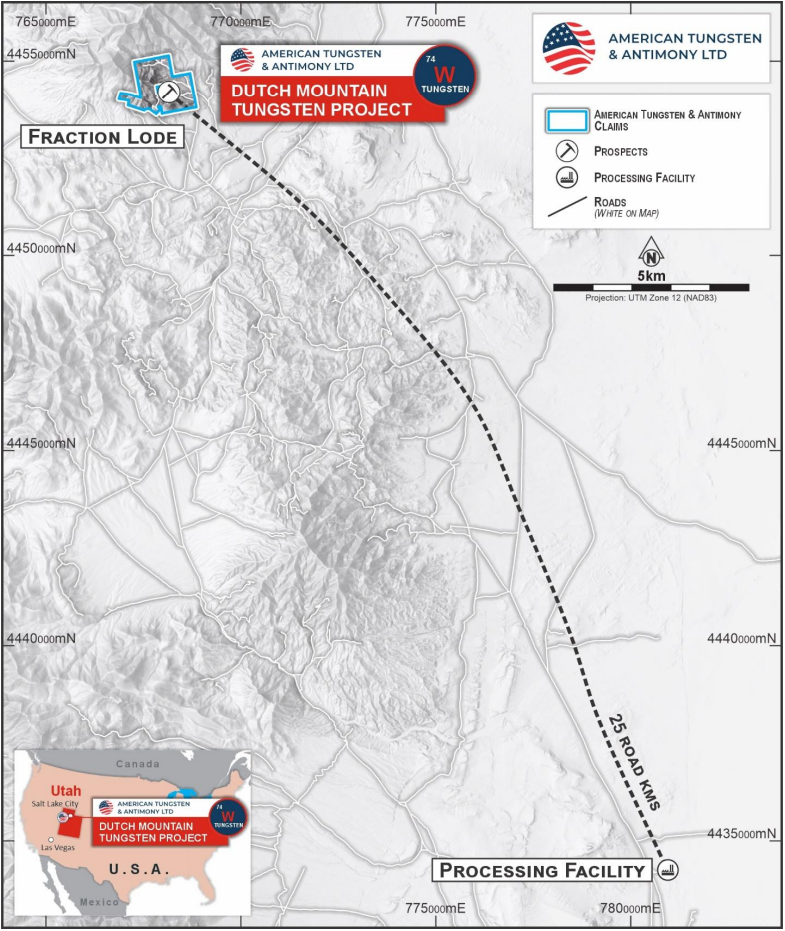

Dutch Mountain Tungsten Project and Processing Facility in Utah, including America’s last operating tungsten mine, Fraction Lode.

The move positions AT4 as one of the very few companies globally with control of permitted, operational tungsten processing infrastructure in the United States, at a time when tungsten prices are rising sharply and Western governments are prioritising secure domestic supply of

critical defence metals.

Tungsten prices rising as global supply tightens

Tungsten has seen a material price increase over the past year, driven by tightening global supply and rising demand from defence, aerospace and advanced manufacturing. Benchmark prices for 65% tungsten concentrate and ammonium paratungstate (APT) have climbed by more than 20% year-on-year, reflecting increasing concern over availability outside China.

A key driver of this trend has been China’s tightening of export controls on critical minerals, including tungsten. As the dominant global supplier, China’s reduced export quotas and licensing requirements have disrupted traditional supply chains and increased strategic risk for Western manufacturers. This has accelerated interest in non-Chinese, domestic sources of tungsten, particularly in the United States.

A rare advantage: a fully permitted US tungsten mill

The centrepiece of AT4’s acquisition is the Dutch Mountain Processing Facility, the only fully permitted tungsten mill in Utah’s Clifton (Gold Hill) Mining District. Importantly, the facility is located on private land and permitted at the state level, allowing AT4 to avoid lengthy federal permitting processes that can take five to seven years for new mining developments.

The mill last processed ore from the Fraction Lode Mine in 2017, demonstrating a proven flowsheet and significantly reducing technical, capital and regulatory risk compared with greenfield processing builds. In an environment where permitting delays are a major bottleneck for new US mine supply, the ability to upgrade and restart an existing facility represents a meaningful strategic advantage.

High-grade historical production underpins the strategy

The Dutch Mountain Project hosts multiple historically producing tungsten mines, led by Fraction Lode, which recorded production of 275 tonnes of scheelite-bearing material at an estimated head grade of approximately 1.7% WO₃, with an average mined grade of around 1.5% WO₃.

Additional historical production from the E.H.B. Lode and Star Dust Mine further demonstrates the high-grade nature of the district. While these figures are historical and not JORC-compliant, they provide evidence of tungsten grades that are highly relevant in the current market, where many operating projects globally run at lower average grades.

Tungsten’s critical role in the military-industrial complex

Tungsten is designated a critical mineral by the United States due to its unique physical properties, including extreme hardness, high density and heat resistance. These characteristics make it essential for armour-piercing munitions, missile systems, aerospace components, high-temperature alloys and advanced industrial tooling.

As defence spending rises and geopolitical tensions increase, the US military-industrial complex has placed renewed emphasis on securing reliable, domestic sources of tungsten. Federal and state-level support for critical minerals projects has increased in recent years, including Pentagon-linked funding, grants and strategic supply initiatives aimed at reducing reliance on foreign supply.

Processing infrastructure unlocks district-scale potential

Beyond its own deposits, ownership of the only permitted tungsten mill in the region provides AT4 with the potential to act as a central processing hub. Numerous tungsten occurrences in the Clifton Mining District remain undeveloped due to the historical lack of compliant processing capacity.

The ability to offer toll-milling or joint-venture solutions could unlock value across the district, creating optionality beyond AT4’s own resources without requiring immediate large-scale mine development.

Expanding scale with Nevada tungsten exposure

AT4 has also secured an option over the Sage Hen Tungsten Project in Nevada, consolidating ground along the Northern Nightingale trend. Sage Hen has recorded historical tungsten production, including hand-sorted material grading up to approximately 1.3% WO₃, and remains largely unexplored at depth using modern techniques.

Together, Dutch Mountain, Sage Hen and AT4’s broader US portfolio form a coherent critical minerals strategy focused on tungsten and antimony, two metals central to defence, industrial resilience and future-facing technologies.

Positioned for a US tungsten revival

With tungsten prices strengthening, China’s export controls tightening global supply, and US policy support for domestic critical minerals accelerating, AT4’s combination of high-grade historical assets and existing permitted processing infrastructure places it in a rare and strategically attractive position.

As the United States moves to rebuild secure supply chains for critical defence metals, AT4 is positioning itself to play a meaningful role in the re-establishment of domestic tungsten production.