ASX: LIB

Our investment pick:

Liberty Metals

Rare Earths, Rutile and Mineral Sands focused explorer

Liberty Metals Limited is an ASX-listed mineral exploration company focused on critical minerals, with an emphasis on titanium and rare earth element projects. The company strategy is to build a portfolio of assets in mining-friendly jurisdictions that can supply materials used in advanced manufacturing, electrification and renewable energy technologies. Its current focus is Brazil, where it has secured several projects targeting high-value heavy mineral sands and rutile deposits.

The company’s main assets are three Brazilian projects. The Paraíba Hard Rock Rutile Project is targeting high-purity rutile mineralisation hosted in hard rock, which has the potential to produce premium titanium feedstock. The Rio Grande Heavy Mineral Sands Project is a large-scale exploration opportunity prospective for rutile, ilmenite and zircon, located near an existing mineral resource that supports the geological model. The Alcobaça Heavy Mineral Sands and Rare Earths Project is focused on heavy mineral sands with additional upside from monazite-hosted rare earth elements, placing it within an emerging rare earth district.

These projects provide exposure to commodities that are important for aerospace, defence, clean energy and high-performance industrial applications. Liberty Metals plans to advance the projects through exploration programs including mapping, trenching and drilling, with the aim of defining initial mineral resources and progressing towards potential development pathways.

Liberty Metals is positioning itself as an emerging critical minerals explorer with a project portfolio leveraged to growing demand for titanium and rare earth supply chains outside traditional producing regions.

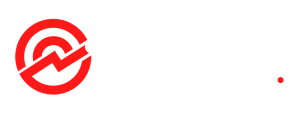

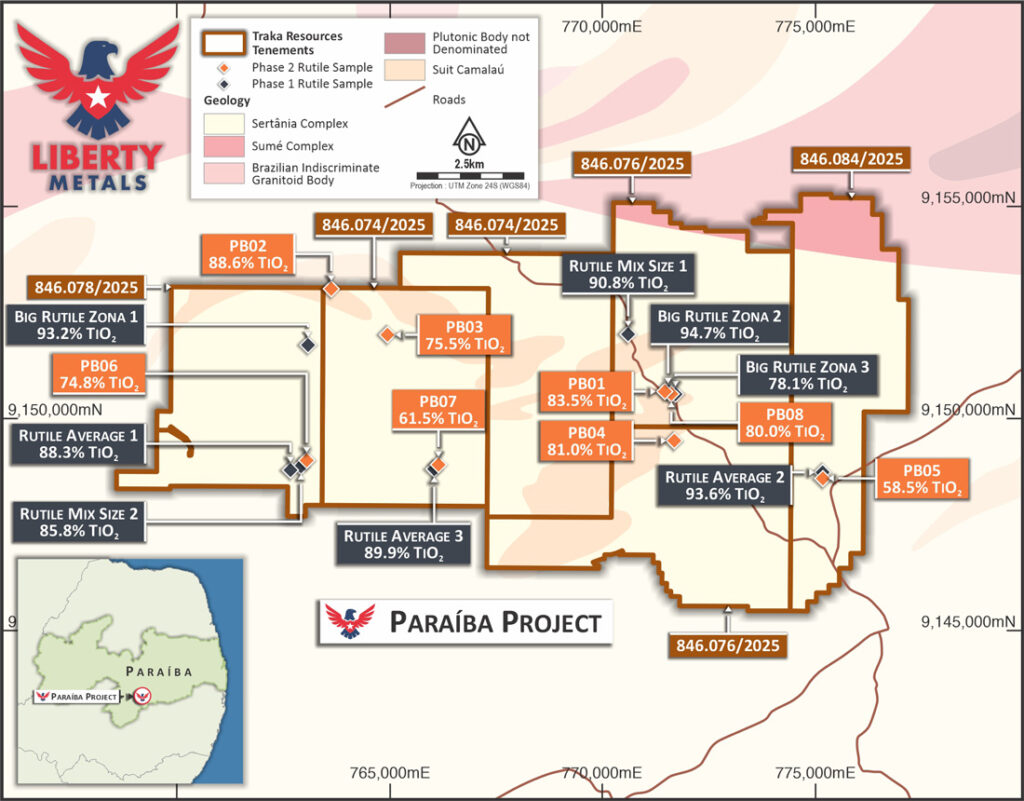

Paraíba Hard Rock Rutile Project

The Paraíba Hard Rock Rutile Project is Liberty Metals’ flagship titanium asset located in north-eastern Brazil within the Borborema Province, covering approximately 120 km² of granted tenure. The project is considered highly prospective for primary rutile mineralisation, which is relatively rare compared to conventional heavy mineral sands deposits. Historical work has identified exceptionally high-grade rutile, with results exceeding 90 % TiO₂, highlighting the potential for a premium titanium feedstock product.

Rutile is one of the highest-value titanium minerals due to its high titanium content and low impurity profile. It is a critical raw material used in aerospace alloys, defence applications, titanium metal production, welding fluxes, pigments for paints and coatings, advanced ceramics and emerging energy technologies. Global supply of natural rutile remains constrained, with declining grades at existing operations and limited new discoveries, supporting a strong long-term market outlook. Demand growth from aerospace manufacturing, electrification, defence supply chains and industrial coatings continues to reinforce the strategic importance of new rutile projects.

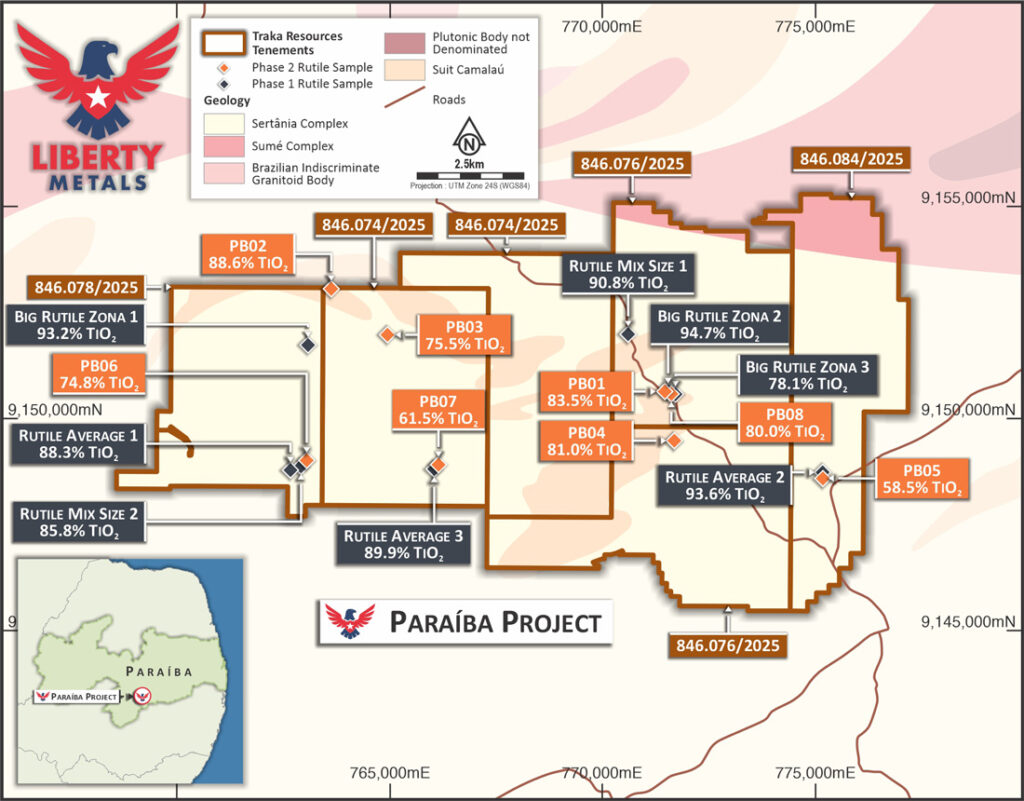

Importantly, recent exploration has significantly expanded the project’s potential beyond titanium. A January 2026 update reported the discovery of high-grade monazite mineralisation associated with the rutile system, indicating district-scale rare earth potential. Laboratory analysis from reconnaissance sampling returned strong rare earth oxide results, including approximately 12.99% cerium oxide, 5.99% lanthanum oxide and nearly 4.7% neodymium oxide, with magnet rare earths representing around 20% of the total rare earth content. These results suggest the presence of a monazite-enriched granite system comparable to deposits being advanced internationally.

Figure 1: Location of the monazite sample (0085/25) within the Paraiba Rutile and Monazite Project, including regional geology, rutile sampling and assay, tenements, and the Project Location.

The confirmation of rare earth mineralisation alongside high-grade rutile materially enhances the project’s strategic positioning, providing potential exposure to both titanium and magnet rare earth markets. The geological model indicates mineralisation occurring within granites and pegmatites, with secondary accumulation in weathered regolith, offering multiple exploration pathways and potential scale.

The Paraíba region itself is a favourable mining location with an established heavy mineral sands industry. Nearby operations demonstrate active production and infrastructure, while growing interest in monazite recovery across the region supports future processing optionality. The state benefits from road access, power infrastructure and proximity to export ports such as Cabedelo and Suape in the broader region.

Brazil is widely regarded as a Tier-1 mining jurisdiction with a mature regulatory framework, strong infrastructure and an experienced workforce. The country is increasingly emerging as a strategic supplier of critical minerals to Western markets, particularly for materials used in energy transition and advanced manufacturing.

Liberty Metals is planning systematic exploration to advance the project, including high-resolution airborne radiometrics followed by auger drilling to test regolith-hosted mineralisation and define scale potential.

Rio Grande Project, Heavy Mineral Sands

Liberty Metals’ Rio Grande Heavy Mineral Sands (HMS) Project is a large, district-scale coastal mineral sands opportunity located in southern Brazil. The project covers approximately 234 km² across 12 tenements in the Mostardas municipality of Rio Grande do Sul and is held 100% by the company. The tenure sits directly adjacent to the advanced South Atlantic mineral sands project, positioning Liberty within a proven heavy mineral sands province with demonstrated large-scale potential.

The Rio Grande do Sul Coastal Plain is a classic setting for HMS deposits. Heavy minerals are eroded from older igneous and metamorphic rocks inland, transported seaward, then concentrated by waves, tides and coastal currents into shallow, laterally extensive sand bodies. The result is typically near-surface mineralisation with straightforward geology, which is why mineral sands projects can often suit low-cost open-cut mining methods, including dredging, where conditions allow.

Rio Grande is positioned beside a substantial development-stage analogue: the South Atlantic Project (Rio Grande Mineração, with Sheffield Resources involved). South Atlantic has a JORC 2012 Mineral Resource (June 2025) of 771 Mt @ 3.0% THM, comprising Retiro (429 Mt @ 3.1% THM) and Bujuru (343 Mt @ 2.8% THM).

That matters because it demonstrates the district can host very large tonnage HMS systems, and it gives Liberty a ready-made technical roadmap for target generation, drilling strategy, sampling and flowsheet thinking. Liberty has also pointed to Sheffield’s work and the fact South Atlantic is being advanced through a pre-feasibility study.

HMS deposits typically contain a mix of valuable heavy minerals, commonly including ilmenite, rutile and zircon. Titanium minerals (ilmenite and rutile) are the key feedstocks for titanium dioxide (TiO₂) pigment, which underpins global demand from paints, plastics, paper and coatings. Rutile is also a premium titanium mineral and is used in titanium metal and welding applications. Zircon is widely used in ceramics (tiles and sanitaryware), refractories and foundry.

The Rio Grande Project provides Liberty Metals with exposure to a large-scale exploration opportunity in a proven mineral sands basin, with the advantage of nearby development activity and regional infrastructure. The combination of favourable geology, adjacent peer validation and strong commodity fundamentals positions the project as a compelling growth asset within the company’s Brazilian portfolio.

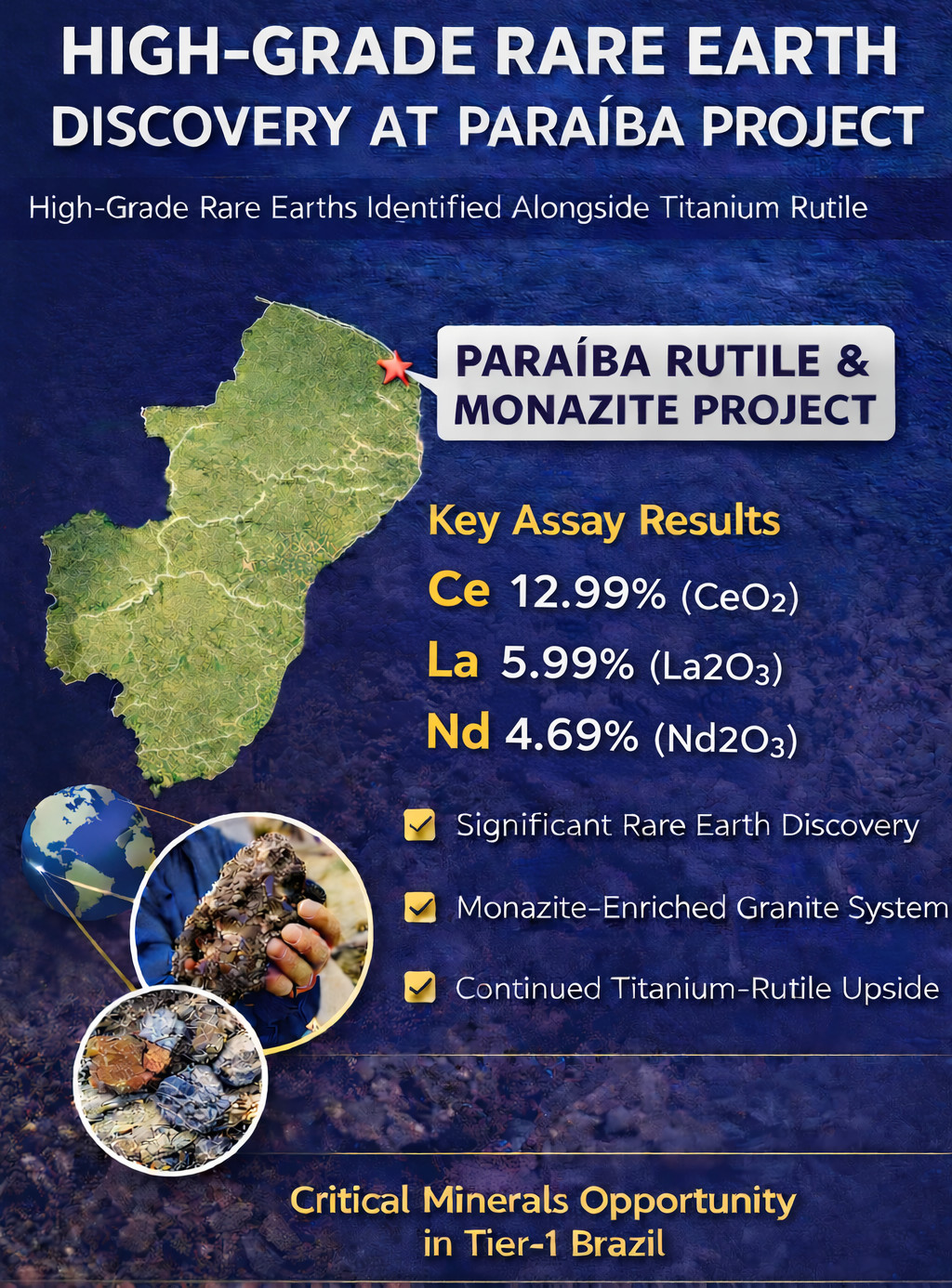

Alcobaça Heavy Mineral Sands Project

Liberty Metals’ Alcobaça Heavy Mineral Sands and Rare Earths Project is a strategically positioned coastal mineral sands and rare earth opportunity located along the Bahia coastline in eastern Brazil. The project covers approximately 55 km² across three granted tenements and is held 100% by the company, providing exposure to both titanium minerals and magnet rare earth elements within a highly prospective geological province.

The project is prospective for a suite of valuable heavy minerals including ilmenite, rutile, zircon and monazite, with monazite representing a key strategic component due to its rare earth content. Rare earth elements hosted in monazite include neodymium, praseodymium, dysprosium and terbium, which are essential for permanent magnets used in electric vehicles, wind turbines and advanced electronics. This dual commodity exposure positions Alcobaça at the intersection of the titanium and energy transition supply chains.

Geologically, Alcobaça sits within a well-understood mineral sands environment formed through a two-stage process. The Tertiary-aged Barreiras Formation provides a mature source of heavy minerals, while later coastal marine processes concentrated these minerals into near-surface deposits along ancient shoreline systems. This style of mineralisation is attractive because deposits are often shallow, laterally continuous and amenable to low-cost open-cut mining methods, similar to many globally significant mineral sands operations.

One of the strongest positives for the project is its location immediately adjacent to Energy Fuels’ Bahia Heavy Mineral Sands Project, a transaction that attracted significant investment attention when ground in the district was acquired for approximately US$27.5 million. The presence of a major international rare earth and mineral sands developer in the same region provides strong geological validation and highlights the emerging importance of the Bahia coastal province for monazite-rich mineral sands.

Liberty’s entry into this district through Alcobaça strengthens the company’s exposure to commodities classified as critical by multiple jurisdictions including Australia, the United States and the European Union.

The project forms part of Liberty Metals’ broader Brazilian portfolio alongside Paraíba and Rio Grande, creating a diversified pipeline of titanium and rare earth opportunities across multiple geological settings. This portfolio approach reduces exploration risk while providing multiple pathways for discovery and potential development.

The Alcobaça Project offers several compelling positives. It combines near-surface mineral sands potential, exposure to high-value titanium minerals, significant rare earth upside through monazite, adjacency to a major peer project and location within a favourable mining jurisdiction.

Conclusion

Paraíba combines high-purity rutile potential with emerging monazite rare earth mineralisation within a monazite-enriched granite system, supported by both primary hard rock sources and secondary regolith concentration in an established mineral sands region.

Positive Commodity Outlook

Titanium feedstocks (rutile/ilmenite): structurally supported by TiO₂ pigment demand (paints/coatings/plastics) plus titanium metal demand in aerospace/industrial applications. Rutile is the premium end of the feedstock spectrum when purity is high.

Zircon: leveraged to construction and ceramics (tiles/sanitaryware) and foundry/refractories; tends to reward consistent quality and stable supply.

Monazite rare earths (NdPr, plus potential heavy REE credits): the strategic demand driver is permanent magnets for EVs, wind turbines and defence/industrial motors. Projects that can demonstrate manageable handling of thorium-bearing streams and a realistic processing pathway tend to attract disproportionate attention.

Brazil Peers: Valuations

Peer activity in Brazil demonstrates the scale of opportunity. Companies such as Tronox operate large mineral sands businesses globally. Energy Fuels has invested in Brazilian mineral sands and monazite supply as part of its rare earth strategy.

Energy Fuels (NYSE:UUUU): market cap around A$7.5 billion to A$9.0 billion. is developing the Bahia Project in Brazil, a significant heavy mineral sand (HMS) operation targeting monazite, ilmenite, and rutile. The project focuses on producing rare earth element (REE) concentrates to ship to their White Mesa Mill in the U.S., with capacity for 3,000–10,000 tonnes per year.

Tronox (NYSE:TROX): market cap around A$1.7 billion to A$1.9 billion. Tronox operates an integrated titanium dioxide business in Brazil, featuring the Guajú mine in Mataraca (Paraíba) and a processing plant in Camaçari (Bahia).

These companies operate at much higher valuations because they hold defined resources or producing assets. Liberty remains at an early exploration stage with a much smaller market capitalisation, which provides leverage to exploration success.